Susan Fahy, EVP and Chief Digital Officer at VantageScore, joined “Money Life” with Chuck Jaffe to share VantageScore’s May 2025 CreditGauge™ insights and data regarding U.S. consumer credit health.

Susan noted that in May 2025, the average VantageScore credit score remained at 702, indicating an overall healthy consumer. Still, mortgage delinquencies are showing signs of potential trouble.

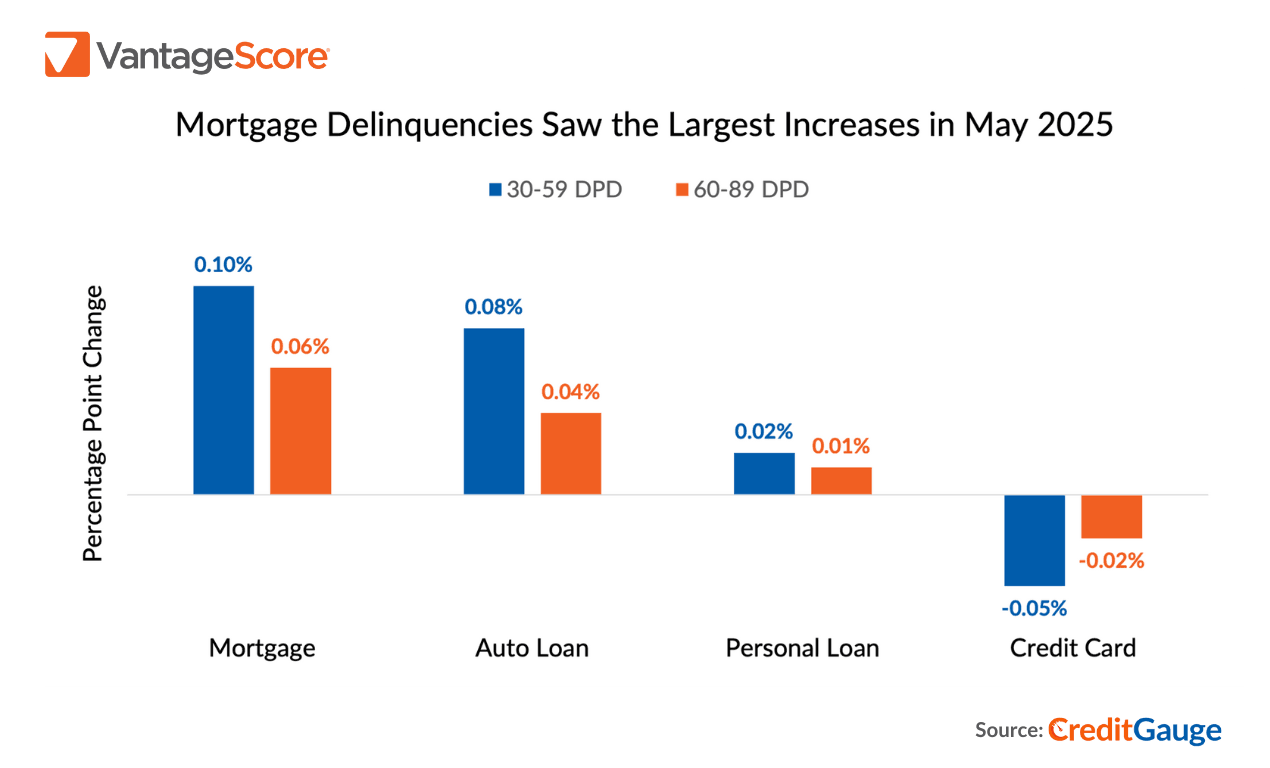

VantageScore saw an increase in mortgage delinquencies, which was surprising because consumers typically prioritize their mortgage payments above all other credit obligations. When we look across all products, mortgage delinquencies increased the most year-over-year and month-over-month.

Susan also reported that credit balances are increasing, even amid cautious consumer sentiment.

Overall credit balances continued to inch higher. In May, it was the fifth month in a row where overall credit balances reached a five-year high, including all products. Consumers are spending as interest rates remain high.

Susan elaborated that consumer behavior and consumer sentiment can show two different feelings.

Oftentimes, what consumers say is not how they are behaving. They could say that they aren’t comfortable spending, yet credit balances continue to rise.

Link to podcast: https://moneylifeshow.libsyn.com/global-xs-helfstein-leans-into-defense-tech-and-cybersecurity-for-back-half-of-25