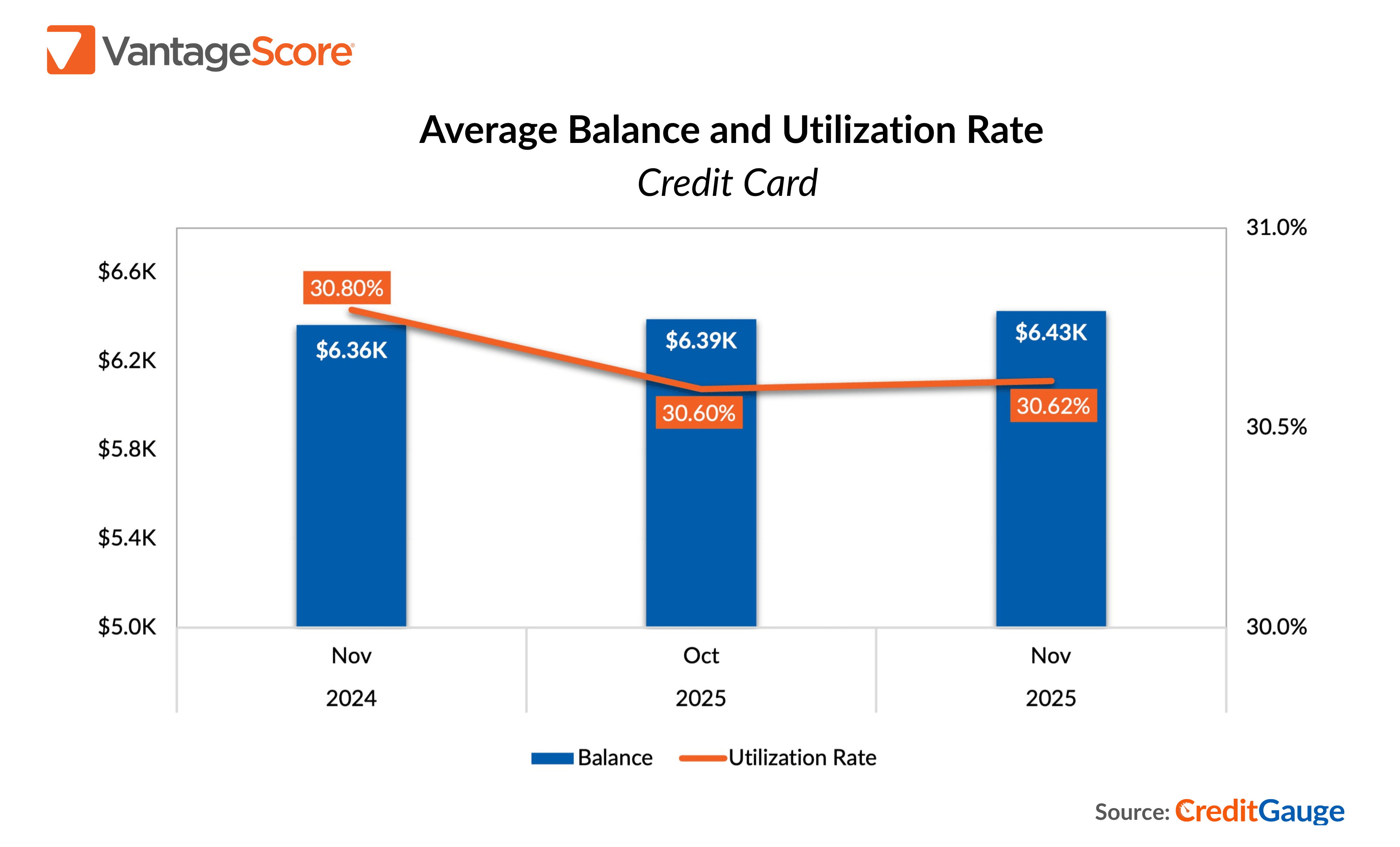

Credit card balances edged higher towards the end of 2025, according to a recent VantageScore CreditGauge analysis. Consumers appear to be tapping additional liquidity even as they worry about keeping up with their debt obligations.

Reports are also increasingly showing a bifurcated, or ‘K-shaped,’ economy, and credit card debt is widening this divide. Roughly 175 million consumers have credit cards. The New York Federal Reserve calculates that while some pay off their balance every month, about 60% of credit card users have revolving debt.

As evidence of the ‘K-shaped’ economy, VantageScore data shows that late payments for high- and middle-income consumers have dropped in recent months, while late payments for lower-income consumers have increased. In this economic environment, some borrowers are struggling to keep up while others have strengthened their financial position, primarily by benefiting from stock market gains and appreciating home values.

Check out the latest delinquency and credit trends on VantageScore’s CreditGauge tool.

Read the full CNBC article here.