- VantageScore Superprime and Subprime Credit Tiers See Rise in Delinquency Rates

- Personal Loan Credit Originations Up as Consumers Refinance Debt with Unsecured Loans

- Rising Credit Card Balances Indicate Increasing Consumer Pressure

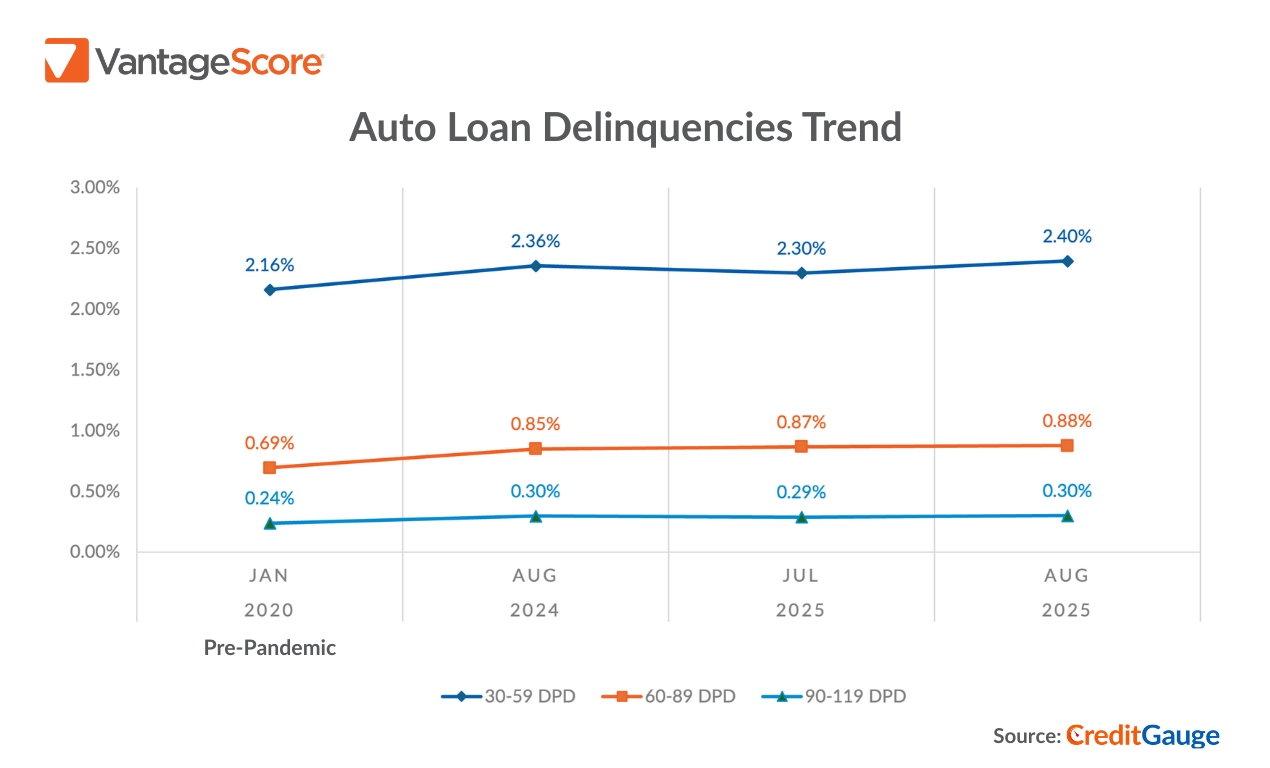

SAN FRANCISCO - September 24, 2025 - Year-over-year, credit delinquencies rose across nearly all VantageScore credit tiers and almost all delinquency categories, indicating that repayment pressures are affecting even the most creditworthy consumers. For example, Auto Loan delinquencies increased across all stages, surpassing pre-pandemic levels, according to the August 2025 edition of CreditGauge™ published today by VantageScore. The average VantageScore 4.0 credit score remained stable at 701 in August.

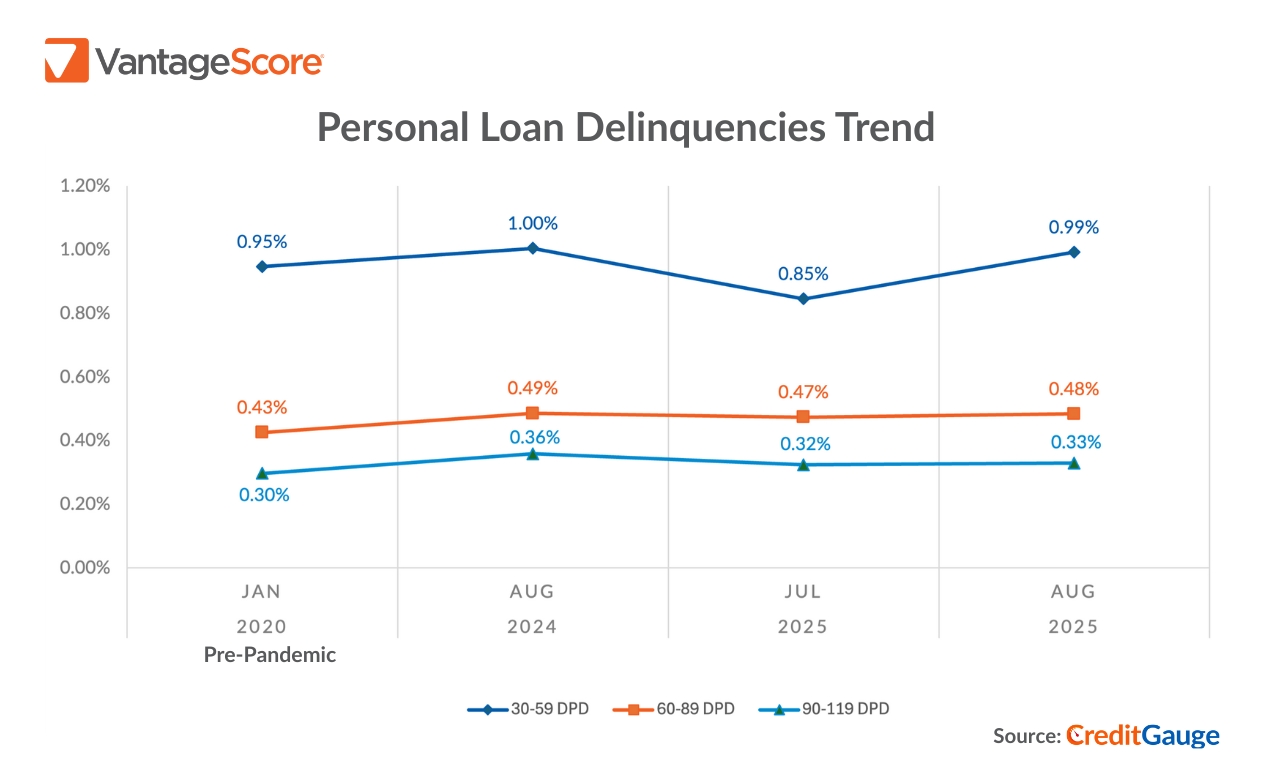

The broad-based decline in consumer credit quality indicates that economic pressures are no longer concentrated among some VantageScore credit tiers and income levels,” said Susan Fahy, EVP and Chief Digital Officer at VantageScore. “For example, the increase in Auto Loan and Personal Loan credit delinquencies likely reflects, in part, the compounding effects of sustained inflation, consistently elevated interest rates, higher borrowing costs, and an unsteady employment picture.

Watch CreditGauge LIVE for additional key insights from the August 2025 edition of CreditGauge that include:

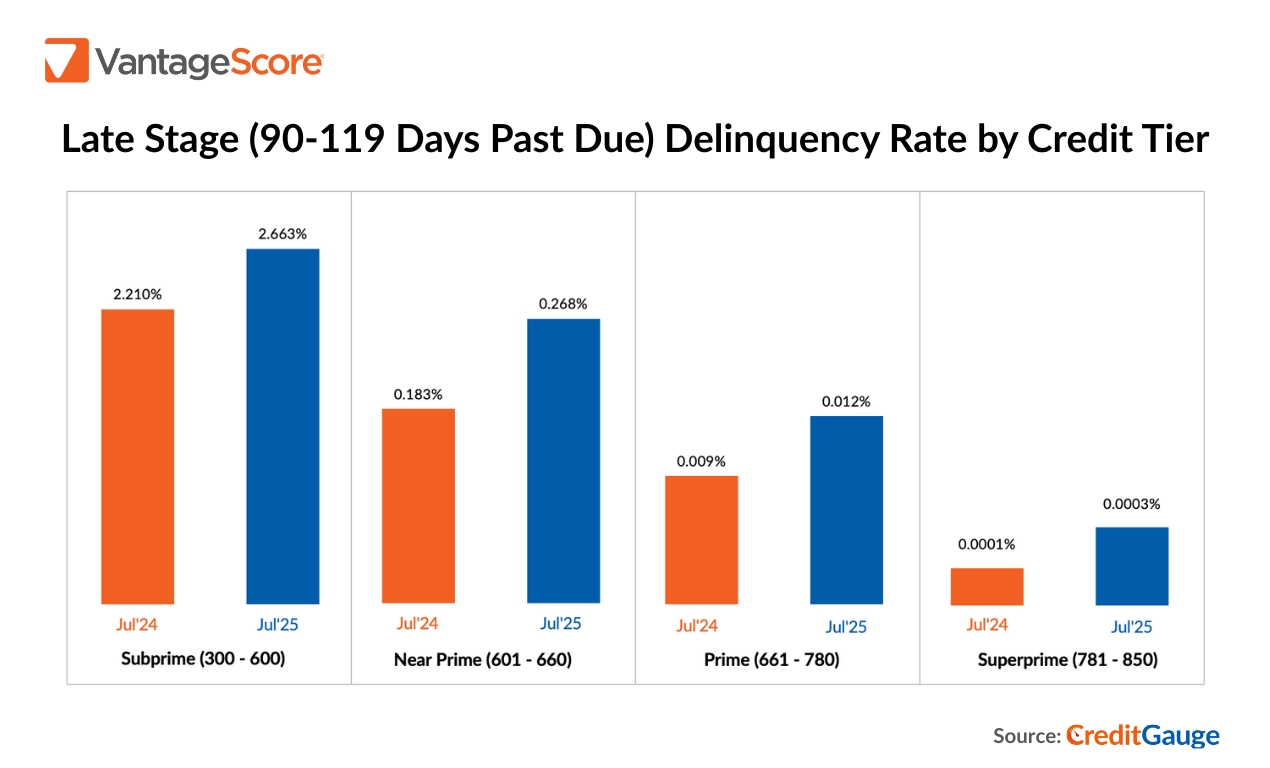

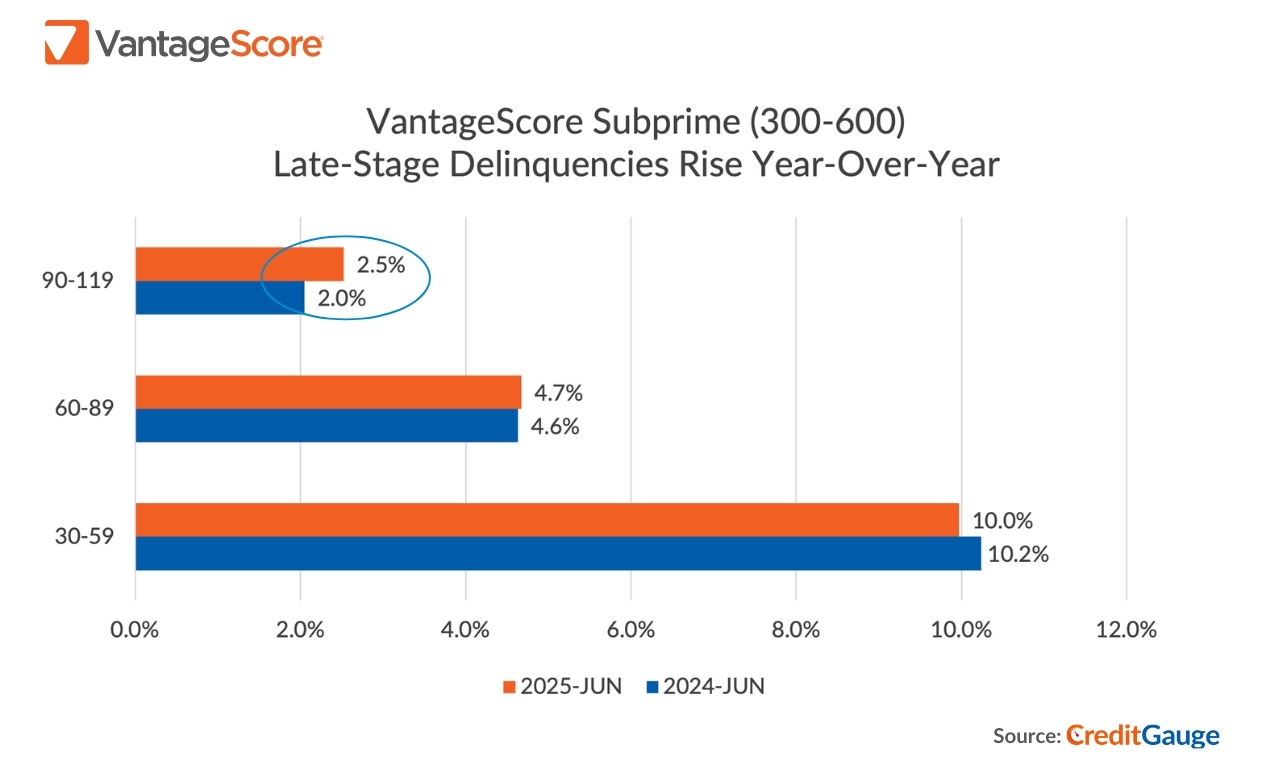

VANTAGESCORE SUPERPRIME IMPACTED: In August 2025, credit delinquencies increased year-over-year across all VantageScore credit tiers and almost all delinquency categories. The most significant increase occurred among VantageScore Superprime borrowers (781-850) in the 90-119 Days Past Due (DPD) category, with an over 300% spike in delinquency levels. While absolute Superprime credit delinquency levels remain extremely low, this sharp uptick indicates weakened repayment behavior even among the most creditworthy consumers.

UNSECURED CREDIT ORIGINATIONS GROW AS CONSUMERS SEEK LIQUIDITY THROUGH REFINANCING: In August 2025, unsecured loan originations rose across key products on a month-over-month basis, led by Personal Loans (+0.45%) and Credit Cards (+0.39%). Unsecured credit originations rose faster than secured ones, reflecting increased demand for liquidity, as consumers refinance debt with unsecured loans.

RISING CREDIT CARD BALANCES INDICATE CONSUMER CREDIT STRESS: In August 2025, the average Credit Card balance rose to $6.5K, up $96 year-over-year and $67 from July 2025. The utilization rate also increased to 30.77%, suggesting increased consumer reliance on revolving credit amid persistent cost-of-living pressures.

Follow VantageScore on LinkedIn and YouTube to watch CreditGauge LIVE, a monthly video series featuring our latest insights on consumer credit data and analysis.

About VantageScore CreditGauge™

CreditGauge is provided both as a monthly analysis to industry stakeholders as well as through a series of interactive tools at VantageScore.com, which also includes Inclusion360®, RiskRatio™ and MarketGain™. Stakeholders can use the tools to execute additional queries on credit metrics and compare current levels to a pre-pandemic timeframe, starting with January 2020. CreditGauge solely represents the views and analysis of VantageScore and does not necessarily reflect or represent the views of the Nationwide Consumer Reporting Agencies (NCRAs) - Equifax, Experian, and TransUnion.

About VantageScore®

VantageScore is the fastest-growing credit scoring company in the U.S., and is known for the industry’s most innovative, predictive and inclusive credit score models. In 2024, usage of VantageScore increased by 55% to hit 42 billion credit scores. More than 3,700 institutions, including the top 10 U.S. banks, use VantageScore credit scores and digital tools to provide consumer credit products or generate greater insights into consumer behavior. The VantageScore 4.0 credit scoring model scores 33 million more people than traditional models. With the FHFA mandating the use of VantageScore 4.0 for Fannie Mae and Freddie Mac guaranteed mortgages, the company is also ushering in a new era for mortgage lending and helping to close the homeownership gap.

VantageScore is an independently managed joint venture company and owners include the three Nationwide Consumer Reporting Agencies (NCRAs) - Equifax, Experian, and TransUnion.