- Auto Loans Emerge as the Most Active Consumer Credit Category

- Early-Stage Credit Delinquencies Improve Across All Products

- Overall Borrowing Levels Plateau, Signaling Growing Consumer Caution

SAN FRANCISCO — May 28, 2025 — Global reactions to the new U.S. tariffs pushed Auto Loans to their highest levels since January 2020, according to the latest edition of CreditGauge™ from VantageScore. Auto Loan originations rose among all generations compared to March 2025, with Gen Z showing the largest month-over-month gain of 0.5%.

“Economic uncertainty was a driver of consumer decisions across all age groups in April,” said Susan Fahy, Executive Vice President and Chief Digital Officer at VantageScore. “Buyers appear to have accelerated their car purchases in anticipation of higher sticker prices due to the recently implemented tariffs.”

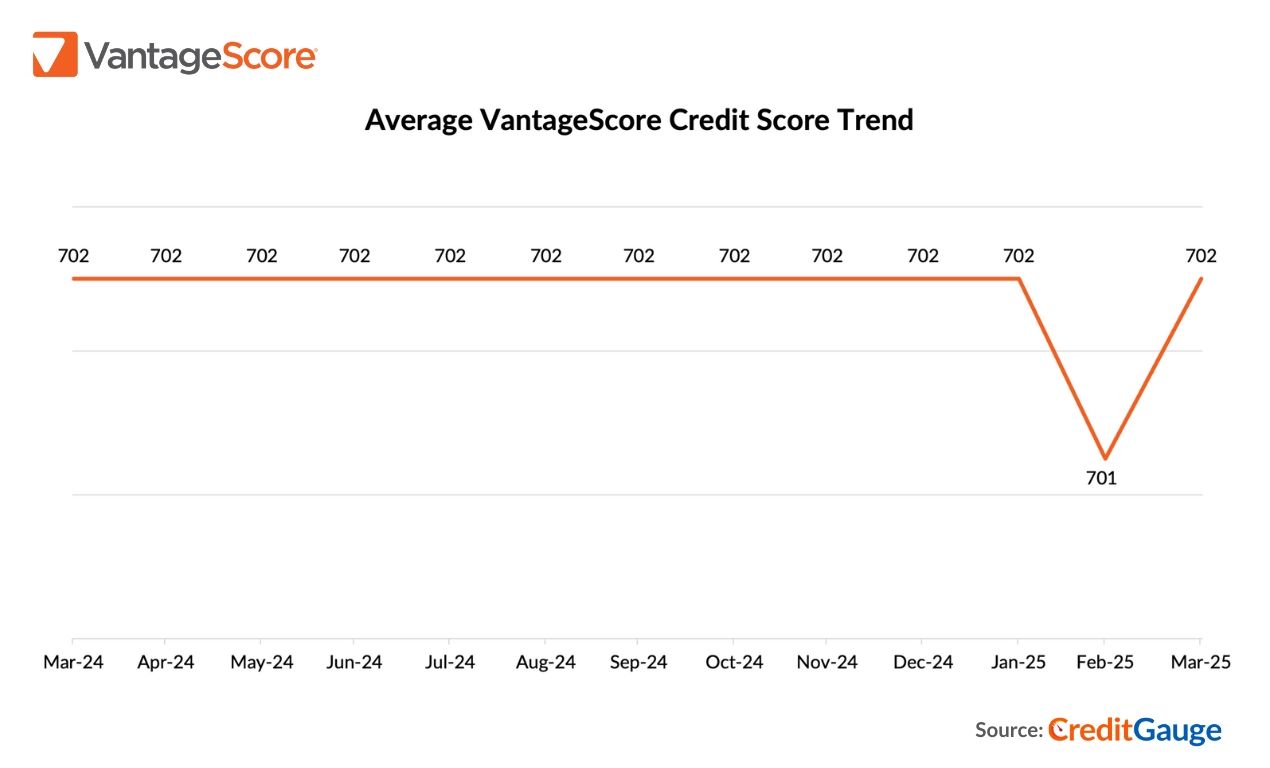

The average VantageScore 4.0 remained steady at 702 in April 2025, edging down by just 0.1 points from the previous month. Meanwhile, the share of VantageScore Superprime (781–850) consumers rose from 30.3% in April 2023 to 31.3% in April 2025, signaling a continued gradual improvement in overall credit health.

Key insights for the April 2025 edition of CreditGauge include:

AUTO LOANS, PERSONAL LOANS LEAD YEAR-OVER-YEAR CREDIT REBOUND: Credit originations increased across all products compared to the prior year, with the highest growth among Auto Loans and Personal Loans. The uptick in Auto Loans likely reflects accelerated vehicle purchases ahead of potential economic volatility, along with seasonal factors like tax refund payments.

EARLY-STAGE DELINQUENCIES IMPROVE: Overall credit delinquencies declined across all Days Past Due (DPD) categories on a month-over-month basis, indicating a short-term improvement in repayment activity. Year-over-year, they remain elevated for both mid- (60-89 DPD) and late-stage (90-119 DPD) delinquencies, the latter likely due to the impact of resumed student loan delinquency reporting on consumer credit files.

OVERALL BORROWING LEVELS PLATEAU: Average credit balances remain essentially flat month-over-month, rising just $14 (+0.01%) compared to March 2025. That said, the average balance-to-loan ratio has trended downward since January 2025, decreasing to 50.81% (-0.64%). Consumers appear to be more discerning and focusing their spending on big-ticket items. Still, average balances sustained a five-year high for the fourth consecutive month, rising by $1,215 (+1.2%).

CreditGauge is a monthly analysis highlighting the overall health of U.S. consumer credit. To download this month’s full CreditGauge report, visit the VantageScore website.

Follow VantageScore on LinkedIn and YouTube to watch CreditGauge LIVE, a monthly video series featuring our latest insights on consumer credit data and analysis.

About VantageScore CreditGauge™

CreditGauge is provided both as a monthly analysis to industry stakeholders as well as through a series of interactive tools at VantageScore.com, which also includes Inclusion360®, RiskRatio™ and MarketGain™. Stakeholders can use the tools to execute additional queries on credit metrics and compare current levels to a pre-pandemic timeframe, starting with January 2020. CreditGauge solely represents the views and analysis of VantageScore and does not necessarily reflect or represent the views of the Nationwide Consumer Reporting Agencies (NCRAs) - Equifax, Experian, and TransUnion.

About VantageScore®

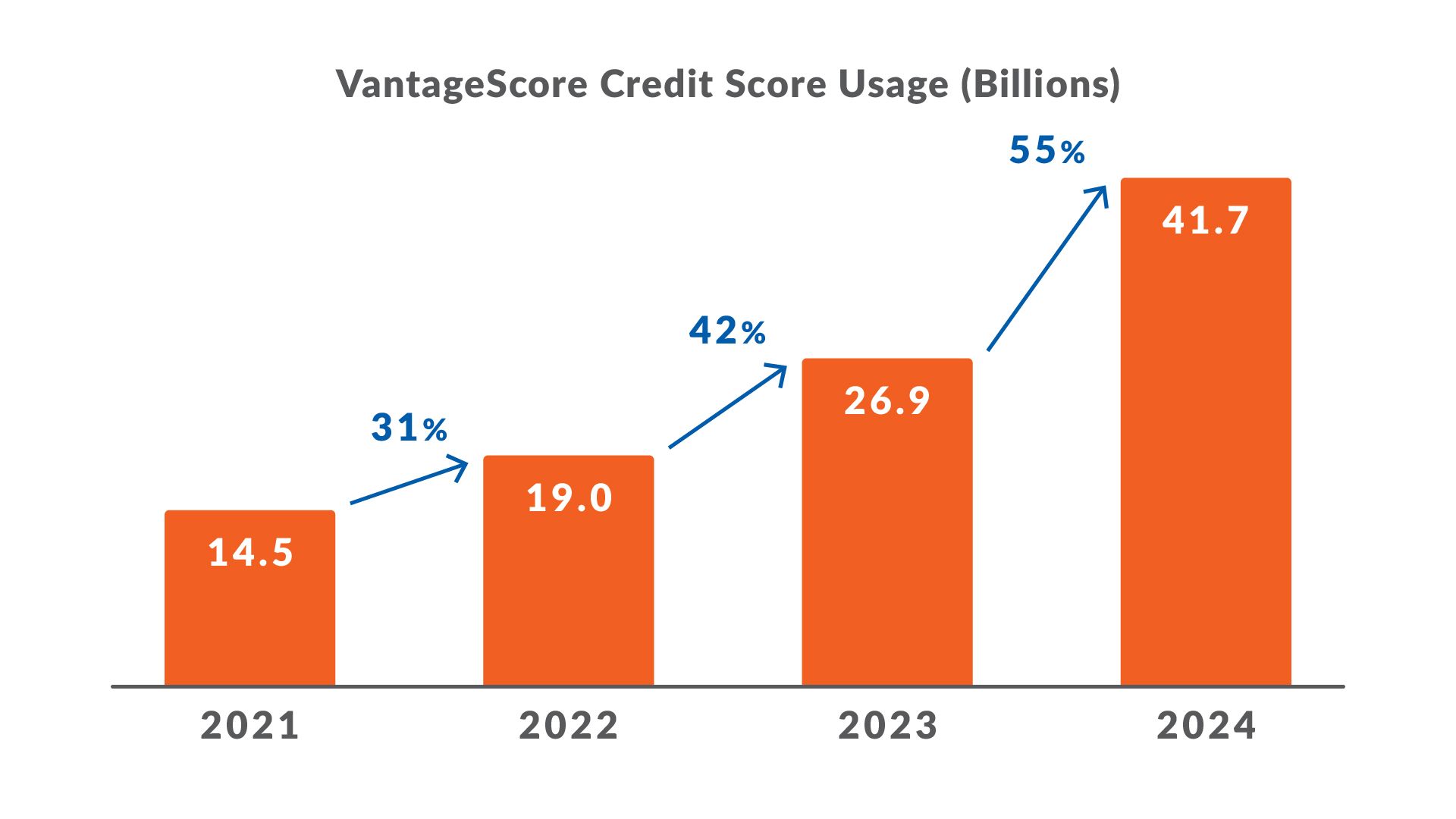

VantageScore is the fastest-growing credit scoring company in the U.S., and is known for the industry’s most innovative, predictive and inclusive credit score models. In 2024, usage of VantageScore increased by 55% to hit 42 billion credit scores. More than 3,700 institutions, including 8 of the top 10 banks, use VantageScore credit scores to provide consumer credit products including credit cards, auto loans, personal loans and mortgages. The VantageScore 4.0 credit scoring model scores 33 million more people than traditional models. With the FHFA mandating the use of VantageScore 4.0 for Fannie Mae and Freddie Mac guaranteed mortgages, the company is also ushering in a new era for mortgage lending and helping to close the homeownership gap.

VantageScore is an independently managed joint venture company and owners include the three Nationwide Consumer Reporting Agencies (NCRAs) - Equifax, Experian, and TransUnion.