The employment environment is worsening, and we’re seeing that in late payments.

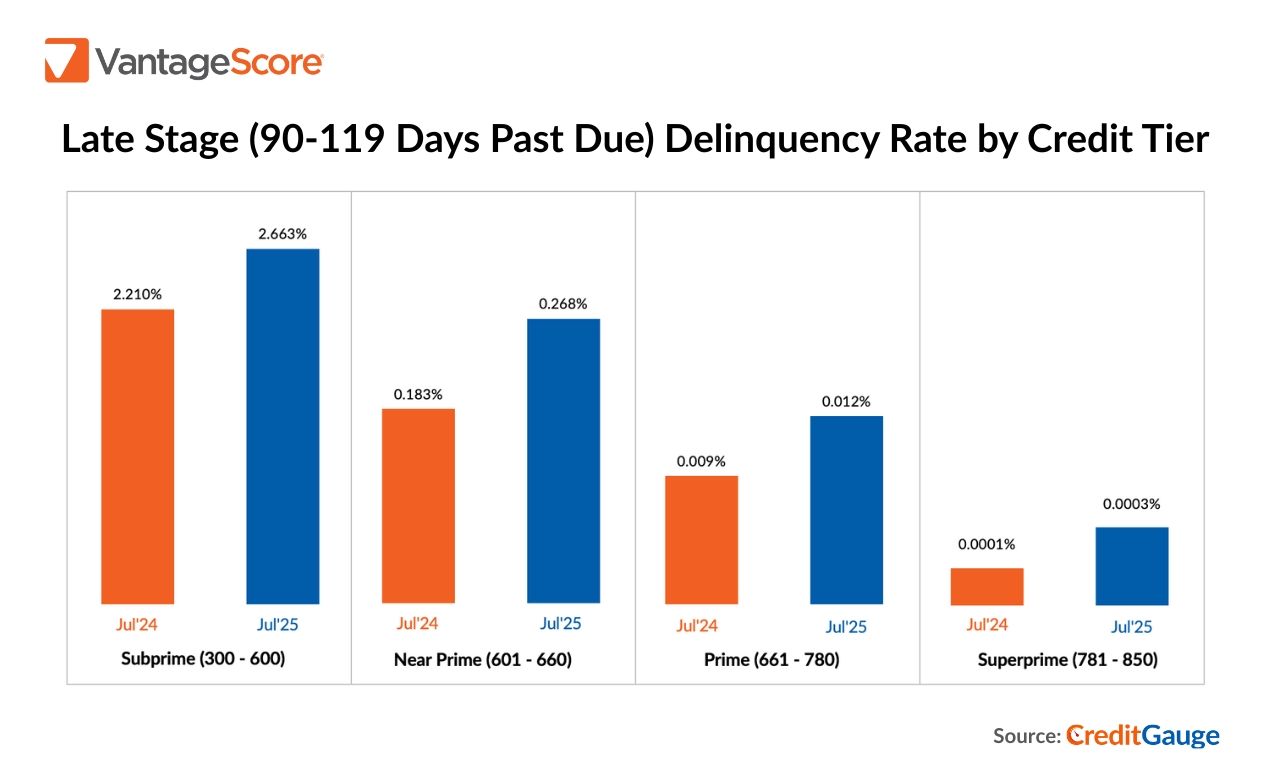

VantageScore President and CEO Silvio Tavares spoke with CNBC to discuss debt struggles faced by U.S. consumers, noting particular trouble with late payments over 90 days. VantageScore’s July CreditGauge shows that late-stage credit delinquencies increased year-over-year across all credit tiers, including among the most creditworthy borrowers.

But the reality is another trend, that’s been going on for some time, is inflation and sustained high interest rates,” added Tavares. “Those are the other key drivers of that change.

In addition, Tavares noted that rising delinquencies and economic uncertainty are impacting lenders’ decisions:

Consumers who take out mortgage loans and auto loans tend to be higher income, more affluent. Obviously, those are big purchases, and we’re seeing them really throttle back their demand for those.

Read more on the state of the consumer in VantageScore’s July 2025 CreditGauge™.

Watch the full interview below: