VantageScore’s 4.0 model predicts 11% more delinquencies than our competitor in a head-to-head comparison.

FHFA’s Decision to Accept VantageScore Will Benefit Millions of Borrowers

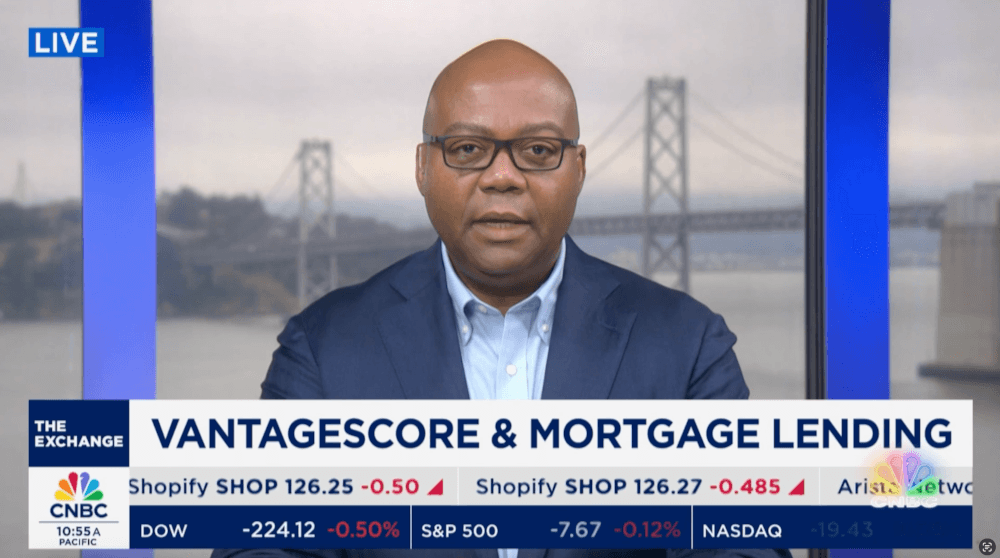

VantageScore President and CEO Silvio Tavares spoke with CNBC to discuss the Federal Housing Finance Agency’s (FHFA) decision to accept VantageScore 4.0 and how it benefits millions of creditworthy borrowers.

We’re in a much different world now, where there is data available that can be used to enhance the predictiveness of consumer credit scores,” added Tavares. “VantageScore has harnessed that data, and it’s time to bring that technology to modernize the mortgage credit scoring system.

FHFA’s Decision Will Open Homeownership to Millions of Americans

In addition, Tavares explained the most important part of the FHFA decision: opening up homeownership to deserving Americans:

Bringing innovation and technology to the mortgage credit score market opens up homeownership to more creditworthy consumers. Because we score 33 million more Americans than our competitors, of that group, approximately 13 million would have a score of 620 or above and five million would be eligible for a mortgage.

For more information on VantageScore 4.0 implementation, please visit VantageScore’s Mortgage landing page.